Rates FAQs

* The pie chart above represents Council's total income.

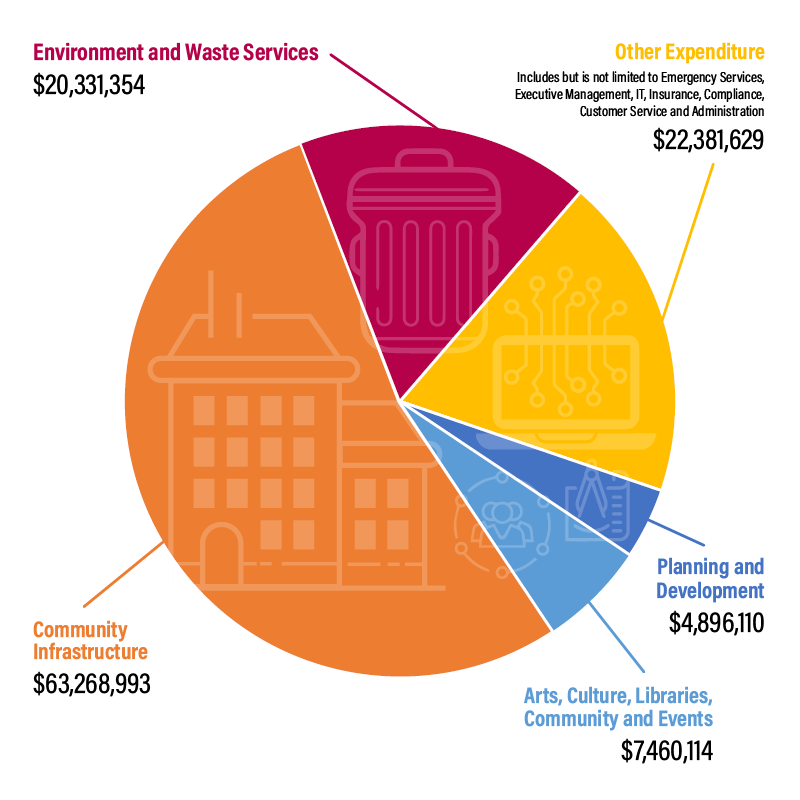

See a breakdown above of how your rates are spent in the Cessnock Local Government Area. Below are some frequently asked questions that will help you better understand more about rates and charges.

Rates FAQs

Why do I have to pay rates?

Councils help local communities run smoothly. They administer various laws and regulations to help maintain and improve services and facilities for the community. These services include community services, sporting and recreation services, environmental planning, public health, environmental protection and waste collection, treatment and disposal. The rates you pay allow Council to fund these services.

How does Council decide how much I have to pay in rates and charges?

Each council is required to determine the combination of rates, charges, fees and pricing policies needed to fund the services it provides to the community. This is called a Revenue Policy. The Revenue Policy contains a rating structure that determines which rates and charges you will have to pay and how they will be calculated. Charges are generally determined on either an annual basis or according to usage – or they may be a combination of both.

Councils can choose how they calculate and distribute rates among categories of rateable properties in the council area. For each category or sub-category, rates can be calculated in one of three ways. They can be based:

- entirely on the land value of the property

- ·on a combination of the land value of the property and a fixed amount per property

- entirely on the land value, but subject to a minimum amount.

The land value is determined by the Valuer General.

What if I can't afford to pay my rates?

You may be eligible for a concession on the grounds of hardship. Council may be able to assist by agreeing to alternative payment plans. Contact Council's Customer Relations Team on 4993 4100.

Can I be exempt from paying council rates?

There are some parcels of land that are exempt from rates and charges. These include parcels of land within a national park and land that belongs to, for example, a religious body or school. Unless you meet the exemption criteria outlined in the Local Government Act 1993, you cannot be exempt from paying rates.

Do I have to pay a domestic waste management service charge if I don't use the service?

Yes. The Local Government Act requires councils to levy an annual charge for providing domestic waste management services on all parcels of rateable land for which the service is available, whether or not it is actually used. It is considered that all property owners should contribute to the current and future provision of waste services.

Land Valuation FAQ’s

What do land valuations have to do with my rates?

Land values are one factor that councils use to calculate and distribute rates. New land values are provided to Council by the Valuer General NSW, every 3 to 4 years. Cessnock City Council then calculates rates based on the land value of your property.

If my land value has increased, does it mean my rates will definitely go up?

No, it depends on how an individual land valuation changes when compared with the average valuation change for the local government area. Properties whose land valuation increase is lower than the average increase will see either a reduction in rates, or an increase smaller than other properties in the same rating category. However, properties whose valuation increase is higher than the average for the local government area will see a rise to rates.

What if I don’t agree with the land value of my property?

In NSW, you can object to a land valuation if you don’t agree with it. Your initial objection should be to the NSW Valuer General, who will obtain a second opinion from a valuer to review the assessment. You have 60 days to lodge your objection. The Valuer General will decide your objection within 90 days. If you are not satisfied with the determination, you can appeal to the Land and Environment Court of NSW. You have 60 days to appeal after your objection is determined. Even if you lodge an objection, you must still pay your rates while your objection is being considered. To lodge an objection, visit the Valuer General’s website.

Does Council get more money because my land valuation has changed?

No, Council does not receive any extra income when land valuations change. The total income generated by Council through rates on existing properties cannot exceed the percentage increase set by the NSW rate peg. So if valuations increase in the local government area by more than the rate peg, then the rates determined by Council must decrease to offset that and keep it below the rate peg limit.

Overall council rate income is proposed to increase by 3.8%. This means that council cannot increase the total income of rates from existing properties by more than 3.8% overall.

What is rate pegging?

Each year the NSW Government, through the Independent Pricing and Regulatory Tribunal (IPART) approves a maximum percentage increase in the total income a council can receive from rates, thereby limiting the amount of income a council can raise via rates.

The rate peg has averaged 2.6% per year over the past 3 years.

Rates Categories FAQ’s

How does council decide which category my property is in?

Each parcel of land must be included in one of four categories for rating purposes – residential, business, farmland or mining. Council decides which category your property should be in based on its characteristics and use. Most people are charged ordinary rates under the residential category.

How does council decide which category my property is in?

Each parcel of land must be included in one of four categories for rating purposes – residential, business, farmland or mining. Council decides which category your property should be in based on its characteristics and use. Most people are charged ordinary rates under the residential category.

What can I do if I don't agree with the categorisation of my property?

Categories are important, because rates differ depending on the category of the land. So if your land is, for example, categorised as farmland you may pay a lower rate per dollar of land value than if your land is categorised as business.

If you are not satisfied with the category given to your property, you may apply to Council for the category to be reviewed. If you do this, council must notify you of their decision and the reasons for that decision. If you still do not agree with the category given to your property, you may appeal to the Land and Environment Court. You must do this within 30 days of receiving Council’s review decision. Contact the court to find out how to lodge an appeal.

Pensioner Consessions FAQ’s

As a pensioner, am I eligible for a concession/rebate on my rates?

Concessions are available for eligible pensioners. To be an eligible pensioner you must receive a pension from either Centrelink or the Department of Veterans’ Affairs, and be entitled to a Pensioner Concession Card or DVA Veteran Gold Card EDA/TPI issued by the Commonwealth Government. You can only claim a concession on the property if it is the sole or principal place you live.

To find out more see Pensioner concessions.

How do I apply for a pensioner concession?

A pensioner concession application can be made over the phone or in person with Council's customer service team. For more information on pensioner concessions visit the Pensioners Concessions page here on Council’s website.

For more information, please contact Council's Customer Relations Team on 4993 4100.